Mastering Risk Management on PrimeXBT

The world of trading, particularly in the realm of cryptocurrencies, is fraught with volatility and unpredictability. Beginner and seasoned traders alike must navigate these complexities to protect their investments. One of the most critical aspects that can mean the difference between success and failure in this arena is effective risk management. A systematic approach, such as the PrimeXBT Risk Management PrimeXBT Risk Management framework, can help traders make informed decisions while minimizing their exposure to potential losses.

What is Risk Management?

Risk management is a strategic approach to identifying, assessing, and mitigating potential financial losses. In trading, it involves implementing measures that allow traders to protect their capital and optimize their profits. Effective risk management is not just about avoiding losses; it’s about creating a balanced trading strategy that includes calculated risk-taking as a component of success.

The Importance of Risk Management in Trading

Successful traders understand that managing risk is as important as knowing when to enter or exit a trade. The crypto market is highly volatile, and prices can swing dramatically in a short period. Here are some reasons why risk management is essential in trading:

- Preservation of Capital: Keeping your trading capital intact is the foundation of long-term trading success. Without effective risk management, a single significant loss can wipe out your trading account.

- Consistent Performance: Managing risk ensures consistency in trading performance. It allows traders to withstand market fluctuations better and stick to their trading plans without being overly influenced by emotions.

- Informed Decision-Making: A solid risk management strategy equips traders with the confidence to make decisions based on analyses rather than emotions.

Key Principles of PrimeXBT Risk Management

On the PrimeXBT platform, traders can adopt various strategies to manage risk effectively. Here are some key principles to consider:

1. Setting a Stop-Loss Order

A stop-loss order is an essential tool in protecting your investments. By setting a predetermined price at which a trade will close to prevent further loss, traders can curtail excessive risks. PrimeXBT offers users user-friendly interfaces to set these orders swiftly.

2. Position Sizing

Position sizing involves determining how much to invest in a particular trade relative to the total account balance. A common guideline is to risk only a small percentage of your total account on a single trade, typically 1-2%. This approach significantly reduces the risk of complete account depletion.

3. Diversification

Diversification is another crucial tactic in risk management. By spreading investments across multiple assets or trading pairs, traders can minimize the impact of a poor-performing asset on their overall portfolio. In the context of trading on PrimeXBT, consider investing in various cryptocurrencies or different market sectors to create a more resilient portfolio.

4. Regularly Reviewing and Adapting Strategies

The market is constantly changing, and so should your trading strategies. Regular reviews of your trading performance and risk management approach are vital to adapting to new information or changing market conditions. It allows you to refine your tactics and improve performance continually.

Utilizing PrimeXBT Tools for Risk Management

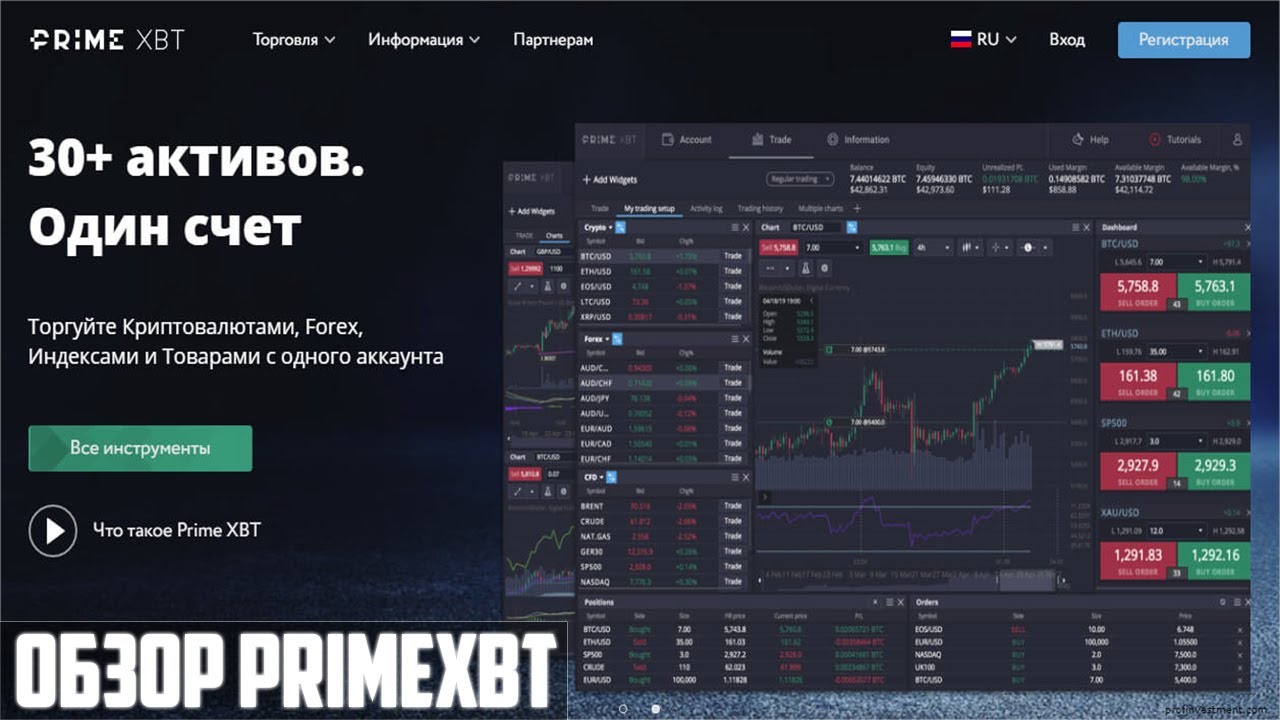

PrimeXBT is not only a trading platform but also a space where traders can utilize various tools to enhance their risk management strategies. Here are some features available on PrimeXBT to help traders manage risk effectively:

1. Technical Analysis Tools

Utilizing charts and technical indicators can help traders make informed decisions. PrimeXBT provides a range of analysis tools that allow users to assess market trends and signals better.

2. Margin Trading

While margin trading can amplify potential returns, it also significantly increases risk. Traders should understand the implications of margin trading and employ effective strategies, such as using lower leverage to minimize risk.

3. Educational Resources

An essential aspect of risk management is knowledge. PrimeXBT offers educational resources, including webinars and article series, which can equip traders with the skills and knowledge needed to make better trading decisions.

Common Mistakes to Avoid in Risk Management

Even with a strong risk management plan in place, traders can fall into common traps that may jeopardize their success. Here are a few mistakes to avoid:

- Ignoring Stop-Loss Orders: Traders may sometimes hesitate to execute stop-loss orders, hoping the market will turn. This can lead to significant losses.

- Overleveraging: Many traders fall into the trap of over-leveraging, thinking they can reap higher rewards quickly. This tactic drastically increases risk and can lead to account liquidation.

- Failure to Adapt: Sticking to a losing strategy without any adjustments can result in continuous losses. Being nimble and ready to change tactics is vital.

Conclusion

Effective risk management is essential for success in trading, especially in the high-stakes world of cryptocurrencies. Utilizing the tools and strategies provided by platforms like PrimeXBT can help traders safeguard their investments while pursuing potential profits. By implementing sound risk management principles, traders can enhance their trading experience, reduce anxiety, and increase their long-term prospects in the market.

Leave a Reply